The Chase Southwest Companion Pass is one of, if not the, best airline perks out there. For people who fly domestically, it is an absolute must-have.

Even for people who don’t fly domestically that often, it can still provide incredible value and is probably worth getting.

Read on to find out what the Southwest Companion Pass is, how to get it, and our favorite ways to use it.

Jump to:

- What Is the Southwest Companion Pass?

- How to Earn the Southwest Companion Pass in 2020

- 5 Awesome Southwest Companion Pass Benefits

What Is the Southwest Companion Pass?

The name of the card is not intended to fool; the Southwest Companion Pass is exactly what it says it is.

The pass allows a companion (spouse, mother, friend, favorite blogger) to fly free with you when you fly on Southwest.

And unlike many other airlines, Southwest does not make the rules super confusing. In fact, the process is fairly straightforward:

- Once a person earns the Companion Pass (how to earn it is discussed below) they will designate the individual they want as their companion.

- The Companion Pass arrives in the mail.

- When the person is booking their tickets online, there is an option to choose to use the Companion Pass. When the person is booking over the phone, they simply have to tell the representative they want to use the Companion Pass.

- The companion flies for free.

About as easy as it gets, right?

Here’s a closer look at how you can earn the Companion Pass:

How to Earn the Southwest Companion Pass in 2020

Technically, there are two different ways to earn the Companion Pass:

- By flying 100 qualifying one-way flights with Southwest in a calendar year.

- Earn 110,00 Southwest points in one calendar year.

Since 99% of people won’t fly enough on Southwest to earn it the first way, we will focus on how to earn 110,000 Southwest points in one calendar year.

At first glance, this may seem difficult, but in fact, it’s not hard AT ALL – below are all the options for earning 110,000 Southwest points in one calendar year.

Option 1: Open Two Southwest Credit Cards

Getting the Companion Pass is so easy because Chase is currently offering three different Southwest credit cards that EACH earn you Southwest points that count toward the Companion Pass.

The amount of points each credit card earns changes throughout the year, but you can generally get these cards with bonuses between 25-60k.

All you have to do is open up two of these credit cards and you’ll be at 110k Southwest points (and the Southwest Companion Pass) before you know it!

Plus vs. Premier Southwest Credit Cards

The first thing to be aware of is that there are two types of Southwest cards, the Plus and the Premier. These cards differ slightly:

- The Plus has an annual fee of $69 and offers 3,000 Southwest points as an anniversary bonus each year you keep it open. Also, it charges a foreign transaction fee of 3%.

- The Premier has an annual fee of $99 and offers 6,000 Southwest points as an anniversary bonus each year you keep it open. It has no foreign transaction fee, so you pay nothing extra when you use it abroad.

The second thing to understand is that Chase offers both a personal and a business version of the Southwest Premier card.

That means there is a Plus personal card, a Premier personal card, and a Premier business card — three opportunities to make the Southwest Companion Pass yours!

To ensure that you get the sign-up bonus for both cards (more than enough points to qualify for the Companion Pass), we recommend opening both a business and a personal card.

Since one is a personal card and one is a business card, you can apply for them at the same time without issues getting approved.

It is possible to reach the necessary number of points by opening two personal Southwest credit cards, but we don’t recommend it, as Chase is unlikely to approve an application for two personal credit cards so close together.

If applying for a business credit card feels intimidating, don’t worry. Here are some tips to get approved for a business card.

Other Ways to Earn Qualifying Points

If you only get approved for one Southwest credit card, or just want to apply for one of the cards, don’t worry, there are plenty of other ways to rack up points towards your Southwest Companion Pass.

Just a quick (but very important) heads-up: Not all the ways that you can get Southwest Rapid Rewards points to count towards the Companion Pass, so be careful.

For example, buying 6,000 Southwest points WILL NOT count towards the Southwest Companion Pass, nor will transferring Chase Ultimate Rewards points directly to Southwest. Transferring points from hotel loyalty programs was also cut out of the equation early in 2017.

Option 2: Spend with the Southwest Credit Card

For each dollar you spend, you’ll earn one Southwest point, so if you spend $6,000, you’ll earn 6k points!

Plus, any Southwest flights you purchase on the card earn you an additional point, making it that much easier to rack up those Rapid Rewards points! For instance, if you use your Southwest credit card to buy a $300 ticket, you’ll earn 600 points instead of just the regular 300.

I’d recommend this for anyone who has a big purchase planned or plenty of monthly expenses that you can pay with a credit card.

Your regular monthly spending could earn you your Southwest Companion Pass in no time!

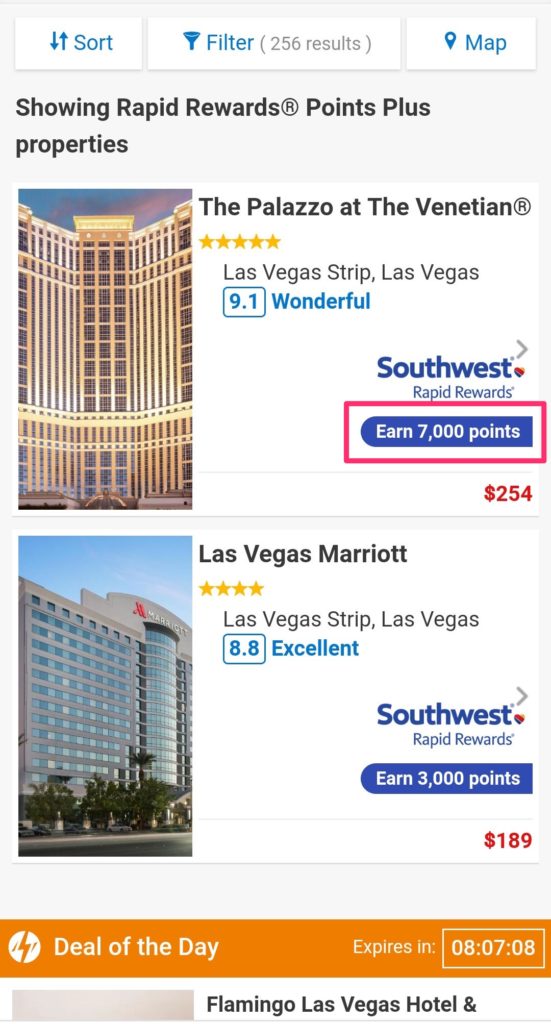

Option 3: Book Hotels Through Southwest Hotels

If you are planning any travel in the near future, consider booking your hotel through Southwest Hotels.

The base rates for points will count towards your Southwest Companion Pass.

Generally, you’ll earn one point per dollar spent on hotels. This isn’t bad, but we can do better — some hotels give you up to 10k points!

For instance, a quick search for a one night stay in Las Vegas shows many hotels with 1-2k Rapid Rewards points per night. A $254 night at The Palazzo will earn you 7,000 Rapid Rewards points when you book it with your Southwest credit card.

And when you pay for the hotel with your Southwest credit card, and you’ll earn an additional two points per dollar. Meaning that, in the above example, your total earnings would be ($254 x 2) + 7,000 = 7,508 points.

Option 4: Shop Through the Rapid Rewards Shopping Portal

Everyone shops online – so why not earn something for it?

There are lots of stores on the Rapid Rewards Shopping Portal that you probably already shop at, so make sure you visit those shops through the portal and earn points towards your Southwest Companion Pass for buying what you were already going to buy!

Earn Rapid Rewards points at websites like Restaurant.com, Home Chef, Shutterstock, Bass Pro Shops, Lord & Taylor, Tumi, Apple, and Nike.

Buying a new iPad Pro? That’s 650 points towards your Southwest Companion Pass.

Buying $100 worth of clothes for the kids at JCPenny? That’s three points per dollar equalling 300 points!

The best part is that you can double dip when you pay with your Southwest credit card. This means iPad Pro purchase has turned into 1300 Rapid Rewards points and the clothing from JCPenney has become 400 points.

All of these points count towards your Southwest Companion Pass!

There are hundreds of websites listed, so make sure you check the Rapid Rewards portal before you click “buy” and you’ll be well on your way to the Southwest Companion Pass!

Option 5: Go out to Eat with Rapid Rewards Dining

If you go out to eat a lot, be sure to take advantage of this opportunity to earn points towards the Southwest Companion Pass.

Signing up for Rapid Rewards Dining Program will earn you up to three points per dollar towards your Southwest Companion Pass at participating restaurants.

That means a $20 dinner would net you 60 Rapid Rewards points!

If you use your Southwest credit card, you can double dip and earn even more!

Your $20 dinner just turned into 80 Rapid Rewards points just by using the right credit card. Who thinks double dipping is bad now?

Option 6: Fly Southwest Airlines

This might seem like a no brainer, but it really does make sense. You’ll earn miles for your fare, plus an additional two points per dollar when you book with your Southwest credit card.

You’ll earn Rapid Rewards points based on the fare you buy:

- 6 points for Wanna Get Away

- 10 points for Anytime

- 12 points for Business Select

If you book a $200 Wanna Get Away fare, you’ll earn 1,200 Rapid Rewards points.

If you book that same fare with your Southwest Credit card, you’ll earn an additional 400 points for a total of 1600 Rapid Rewards points!

A $300 Anytime fare will earn you 3000 Rapid Rewards points (300×10=3000!)

If you’re a little short on Companion Pass qualifying points, spending a little extra on your next Southwest flight could bump you up to two for one travel for the next year!

5 Awesome Southwest Companion Pass Benefits

Still not convinced of the value of the Southwest Companion Pass? There are five things that make the Companion Pass especially awesome. Let’s take a look at them:

1. You Can Use the Pass Unlimited Times

This is not a one-time pass, but instead allows a companion to fly free with you EVERY TIME you fly Southwest.

Yes, you are hearing me correctly: EVERY SINGLE TIME you fly Southwest.

Theoretically, I could fly Southwest every day and my companion would fly free with me each and every time.

2. The Companion Pass Can Remain Valid for Up to 2 Years

You may think you are mishearing misreading me, but you aren’t. The Companion Pass is good for the year you earn it and the next calendar year as well.

Example: Let’s say you get your Companion Pass on October 1st. Your Companion Pass will then be good for October, November, and December of 2020 and then all of 2021, for a total of 15 months.

Of course, the way to squeeze maximum value out of it is to get it as early in the year as possible (like January) and then you’d have it for a full two years.

Bingo!

3. Your Companion Flies Completely Free

With most things in life, free doesn’t mean free, and a lot of times there is enough red tape and rules to make the “free” item not even worth it.

This is NOT the case with the Southwest Companion Pass.

In this case, free really does mean free.

The only thing that the companion will be required to pay is a government-mandated September 11th security fee and taxes which is about $5.60 one way.

Other than that, there are no costs for the companion whatsoever.

And in case you’ve been hiding under a rock for the last two years, you should be aware that bags fly free on Southwest (awesome commercial evidence here, here, and here), so the companion won’t even have to worry about that cost!

4. You Can Use the Companion Pass on Both Paid and Award Flights

Whether you pay out of pocket for your flight or use some of the Southwest miles you’ve accumulated to get an award ticket, your companion can still fly free with you.

This is basically unheard of in the airline world, as every other companion pass (that I’m aware of) requires the original person to pay for their ticket.

Not on Southwest.

So whether you pay $500 for a last-minute ticket, $150 for their normally cheap regular fares, or fly free yourself using your Southwest miles, your companion can come along as well.

What’s better than one person flying free on Southwest?

TWO PEOPLE FLYING FREE ON SOUTHWEST!

5. You Can Change Your Designated Companion Up to 3 Times Per Year

After you originally designate your companion you can change it and get a Companion Pass reissued with another person’s name up to three times a calendar year each year you maintain your Companion Pass.

This can be done instantly over the phone and is an awesome perk that often gets overlooked among all the other amazing things about the pass.

I’ll give you a good example of how I plan to use this to my advantage.

Naturally, Heather (my wife) will be my companion on many of my trips.

However, instead of designating her as my original companion, I plan on designating my best friend Jon because we are planning a trip together down to Florida.

After we take our trip and he flies for free (saving him anywhere between $150-300), I’ll call in and ask to designate Heather as my new companion.

Then, we’ll use the Companion Pass to fly all over this awesome country of ours.

You can even designate a new companion (i.e. Jon), change it to someone else (Heather) and then change it back to the original person (Jon).

FINAL WORD(S)

The Southwest Companion Pass is an amazing, amazing perk and even those who only occasionally fly domestic should consider it. Southwest is expanding its route network every year with flights to the Caribbean and Latin America already happening.

For anyone who flies a decent amount (or would if it was cheaper), it’s an absolute must.

Grab a personal and business card, find a good companion, and experience the joys of free travel!

If you’ve got the Southwest Companion Pass, weigh in below. Is my love for it justified? Where have you gone with it? If you don’t have it, how do you plan on getting it? Fire away!

I am going to be charged for an annual fee for my Southwest Chase Card in Mid Oct-2018 and I want to avoid this by cancelling my credit card before that. But on the other hand I have booked a trip for Dec-2018 where I am taking an advantage of Companion Pass. So question is “Can I cancel my Southwest Chase Credit card and still be able to use companion pass advantage until the end of 2018?” I don’t want to find out on the day of my trip that my companion ticket is no longer valid as I cancelled my Credit Card.

@Pratik Shah – Yep, once you get the Companion Pass, you have it, no matter if you cancel the card or not.

My husband is my companion and we have flights booked for end of sept and middle of November.

However I am going to fly in October and he cannot make it so my friend was going to come with me as my companion. It says they need 21 days to process the change so I don’t know if this is enough time to switch to her after sept and then switch back for the November flight. Will they change it so I can add her to my flight within a few days or should I not risk it. Also, do you know if I will have to cancel my husbands passs for November and can I add him again after I reinstate him to be my companion? Would I have to pay taxes again?

Thanks!!

My husband is my companion and we have flights booked for end of sept and middle of November.

However I am going to fly in October and he cannot make it so my friend was going to come with me as my companion. It says they need 21 days to process the change so I don’t know if this is enough time to switch to her after sept and then switch back for the November flight. Will they change it so I can add her to my flight within a few days or should I not risk it. Also, do you know if I will have to cancel my husbands passs for November and can I add him again after I reinstate him to be my companion? Would I have to pay taxes again?

Thanks!!

Trav! I am about to pull the trigger on this operation. I received the 50,000 bonus point email offer and also see that the rapid rewards premier business card is offering 60,000 points. Just to verify, both of these cards under my name will pool the points and reward me the companion pass after meeting the spending requirement, correct?

@Tony – Yep, you’ll need to make sure you tie the same Rapid Rewards number to them when you sign up, but yes, they will both go to the same account if you do that.

I have a few referrals left for the Southwest PLUS and PREMIER 50,000 points credit card. Spend $2,000 within the first three months to earn 52,000 per card! Please email me at phu_anny at hotmail.com

SOUTHWEST PREMIER

https://www.referyourchasecard.com/224/OQNQKS20A9

SOUTHWEST PLUS

https://www.referyourchasecard.com/223/YPX3HRHZ8V

I have referrals for both the Southwest Plus and Premier cards. Both come with a 50,000 point sign up bonus. Get both and you will be well on your way to earning the Southwest Companion Pass.

Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FQWW&CELL=63HB&MSC=1526257827

Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FQX3&CELL=63HB&MSC=1526260153

Thanks and good luck

I have referrals for both the personal plus and premier cards. Email me at kap20k4 [at] hotmail [dot] com.

Hi Trav,

I was going to try of the CP, there are two personal cards right now offering 50k points.

If I apply for one personal card, how long do i need to wait in order to get the other one? Currently I only have one credit card.

Thanks and love your site!

@Mister Wayne – Two personal can be tricky. I’d wait at least 3 months between them because if you don’t, it might be hard to convince them of why you might need two.

Southwest Plus and Premier referrals. Both cards come with a 50,000 point sign up bonus after meeting the $2,000 minimum spend. This is an easy way to earn the Southwest Companion pass.

Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FQWW&CELL=63HB&MSC=1526257827

Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FQX3&CELL=63HB&MSC=1526260153

Thanks and good luck. If you have any questions, don’t hesitate to ask.

50,000 point referrals for both Southwest personal cards are available again. The beginning of the year is the perfect time for it too if you were wanting to earn the companion pass.

Southwest Plus:

https://www.referyourchasecard.com/223/LI9O5ETH4K

Southwest Premier:

https://www.referyourchasecard.com/224/0Z5RQAYH6N

Thanks for using and good luck

Southwest Premier -> https://www.referyourchasecard.com/224/D2HL12LYFI

Southwest Plus -> https://www.referyourchasecard.com/223/0XDKTKK7NE

Southwest Premier -> https://www.referyourchasecard.com/224/D2HL12LYFI

Southwest Plus -> https://www.referyourchasecard.com/223/0XDKTKK7NE

Chase Sapphire Reserve -> https://www.referyourchasecard.com/19/XCY4JBEMMU

If anyone needs southwest 50000 points bonus offer, please reach out to southwestpoints2018@gmail.com

Southwest Chase Plus and Premier 50k points link below. These are my unique links and I will get referral points if you use them, so please use them :)

Plus

https://www.referyourchasecard.com/223/MO7G9U500I

Premier

https://www.referyourchasecard.com/224/WFJRI5KMJY

I have a question. I have just become an authorized user on someones card and they also earned the free companion pass for 1 year for being a California resident (current promotion). Will the companion be able to fly with me as well since I’m an authorized user on the card or only the primary card holder?

@Charis – No, they will only be able to fly with the person whose Southwest account the card is tied to, which would be the primary cardholder.

Hi, Trav! Thank you for all the info.

Will I automatically get the Companion Pass in the mail once I reach the minimum 110K southwest points? Or will I need to affirmatively call Southwest and request to receive the Companion Pass? How’s that work? :)

@Stephen – My pleasure! You should receive it in the mail once you hit the 110k points. But, it never hurts to call and nudge them along if you don’t get it right away!

Any current 50,000 mile referrals out there. Thanks!

Hi Trav! Quick question – got your 10/18 email that said Chase is offering a 60k point bonus, but when I went on Chase’s site, I only saw 40k for personal and 60k for business. I’m planning to sign up for both, but I’m wondering….is there a personal 60k point bonus somewhere? Just want to double check before I sign up. :)

P.S. You are awesome and I love your site!!!

@Joy – Unfortunately, I think that both personal cards are back down to 40k right now. But that, coupled with the 60k biz card, is an awesome start towards the CP. So glad you like the site – we’ll keep putting out great stuff if you keep reading and listening!

I received the pass in March. I had accrued enough point 1/17. I received a card in the mail once I added hubby as companion. The card says expires 12/17 of this yr would that be correct? I currently have 67000 points do I need to get this up to 110,000 before end of yr to get pass again into 2018. If I don’t need these rewards then do the rewards reset 1/18? My bill comes due 22nd of each month should I change due date?

Thanks

@Nancy – if you earned the points in January of 2017, the companion pass should be good until 12/2018. So if that is the case, I would call up Southwest and see what happened there. It’s good for the year that you earned the 110,000 points and the next year as well.

Only reason I can see why it might say 12/17 is if you earned the points in 12/16 and not 1/17. But call them up to clarify, as they will be able to pull it up. And enjoy your Companion Pass!

I just applied and was approved for the Plus card this morning. I want to open a second card so I can get the Companion Pass – should I wait before doing so or can I go ahead and do it now (worried the deal will end!)? Also, would you recommend the Premier or Business card for my second one?

@Sandra – If you’re opening a business card, you could probably do it in the next day or so. But if you’re going for the Plus (which would be a 2nd personal card), I’d wait at least 3 months.

If you have a business, I’d definitely recommend the business card. It will be easier to get.

If anyone is interested in applying for the Southwest Premier or Southwest Plus, I have referrals. Both cards come with a 50,000 point bonus after meeting the minimum spend. It’s an easy way to earn the Southwest companion pass. If interested click on the links below.

Here is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

and here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

I will receive a 5,000 point referral bonus for each card approved through my links. Thanks!!

Earn 50,000 bonus points with the Southwest Rapid Rewards® Plus Credit Card. Learn more at.

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HK&MSC=1495229697

Earn 50,000 bonus points with the Southwest Rapid Rewards® Premier Credit Card. Learn more at.

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63GZ&MSC=1529220312

Please consider using my Southwest 50K Bonus Referral links for achieving South West Companion Pass and help me achieve the same.

Lets Win – Win

SW Plus Card

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1538357440

SW Premier Card

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1539282418

Reply

This is from the terms and based on that nothing in this article is true:

Companion Pass

A Member who earns 110,000 Companion Pass Qualifying Points or who flies 100 qualifying one-way flights booked through Southwest Airlines per calendar year will qualify for Companion Pass. Companion Pass Qualifying Points are earned from revenue flights booked through Southwest Airlines, points earned on Southwest Airlines Rapid Rewards Credit Cards, and base points earned from Rapid Rewards Partners. Purchased points, transferred points transferred between members, points converted from hotel and car loyalty programs, and e-Rewards, e-Miles, Valued Opinions and Diners Club, points earned from program enrollment, tier bonus points, flight bonus points, and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass Qualifying Points. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards Account. Only points posted on your billing statements and posted to your Rapid Rewards Account during the same calendar year are available for qualification for Companion Pass status. No points or Companion Pass Qualifying Points will be awarded for flights taken by the Companion using the Companion Pass.

Please let me know if this route has worked for anyone recently.

@Brian – Yes, it still works as of today, February 3, 2017. In March, you won’t be allowed to transfer hotel points to earn it, but you can right now. And points earned through SW credit cards do count.

Question: We got 100K points for applying for the Chase Sapphire Reserve card. If I understand correctly — if transferred to Marriot, this equates to only 60K points that can be used towards the companion pass status. In order to get the remaining amount, can I just create a Marriott rewards account and purchase 50K of marriot reward points for $625? Would that get me the companion pass????

@Hailey S – I didn’t check your numbers, but the process you mentioned would work. HOWEVER, hotel points will not count towards after March 31, 2017.

So all the transfers would have to be completely finished before that date. So if you started now, you should be ok.

I will say that transferring all those Chase Sapphire Reserve points to Marriott and then to SW does lose you a ton of value. Yes, you get the companion pass, but you are losing some very valuable Chase points.

I have a few referral links left for each of the credit cards (PLUS and PREMIER) with 50,000 bonus points. Spend $2,000 within the first three months to get 50,000 points.

Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTY&CELL=63GM&AFFID=&CLICK=&CID=&PROMO=DF01&MSC=1528979872

Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTM&CELL=63GM&AFFID=&CLICK=&CID=&PROMO=DF01&MSC=1530349591

The offer expires on February 9, 2017 so hurry and apply and get your companion pass early on in the year!!

I have referrals for SW Premier if anyone is interested. Spend $2k get 50,000 miles.

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HL&MSC=1538406033

If anybody needs referrals, I have them for both Southwest personal cards. The signup bonus is 50,000 points each.

Here is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

and here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

I will get 5,000 point referral bonus if you apply and are approved through my link .

Thanks

I have referral links for both the Plus and Premium, 50K bonus. Email me at emilybhaha@gmail.com!

I have referrals for the plus card with 50,000 points if anyone needs one. Send me an email billingskayla@gmail.com

Please consider using my Southwest 50K Bonus Referral links for achieving South West Companion Pass and help me achieve the same.

Lets Win – Win

SW Plus Card

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1538357440

SW Premier Card

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1539282418

Hi Trav,

First, I want to say I love your podcast. You, Heather, and Jason have made my day for weeks now as I have binge-listened to EPOP podcasts. To make a recommendation, updated lists are always appreciated.

As a data point, moments ago, I applied for both personal Southwest cards via referral links and was approved for both. I was concerned because I have several cards with Chase already, so I figured I was destined for the reconsideration line, but no, I was approved for both, albeit with low-ish limits, but that’s okay with me. Companion Pass, here I come! Thank you for everything.

@Josh – Awesome, congrats on getting approved. The CP rules! And glad we can make your day – you made mine with those awesome words of encouragement. Cheers buddy!

I have a few referral links left for each of the credit cards (PLUS and PREMIER) with 50,000 bonus points. Spend $2,000 within the first three months to get 50,000 points

PLUS

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63GZ&MSC=1523760516

PREMIER

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63GZ&MSC=1520472910

I have a few referral links for the Southwest PLUS and PREMIER 50,000 bonus point. Please email me at phu_anny@hotmail.com. Thank you!

We are trying for our first Companion Pass and could use some help by applying with our links. This is a Great time (first of the year) and way (100,000 points for both card bonuses) to start working towards your own companion pass. Just follow these links…..

Thank You!!

SW Premier Card

Earn 50,000 bonus points with the Southwest Rapid Rewards® Premier Credit Card. Learn more at. https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1537262422

SW Plus Card

Earn 50,000 bonus points with the Southwest Rapid Rewards® Plus Credit Card. Learn more at. https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1537259760

Chase Freedom Card

Earn $150 cash back with Chase Freedom®. Apply at:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FJF6&CELL=63HB&MSC=1429416252

Also, here is the link for the Premier Card. It will allow you to get 50,000 points and an additional 5,000 for using my referral. Thanks so much!

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1501199015 #sponsored

I have a friend who accidentally applied for the Plus card a month ago through a 40k link even though plenty of 50k offers are available. Is there any chance to reach out to chase and see if they would honor the 50k bonus?

@Eugene – Have them call up. Usually Chase will honor it if it was within a few weeks. Can’t hurt to try.

If anybody is looking to earn the companion pass, I have the referral for the Southwest Premier card with the 50,000 point bonus (Spend 2K in 3 months). Click on the links below for details.

Here is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTY&CELL=63GM&AFFID=&CLICK=&CID=&PROMO=DF01&MSC=1528979872

I will post the link to the Southwest Plus card later this week or you can email jreid045@gmail.com and I will send you a link. Let me know if you have any questions about the companion pass!

Hey Guys: Here is the link to the Southwest Plus Card for 50,000 Points:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1537538492 #sponsored

Thanks!

Here’s a link for the 50,000 point bonus on the Southwest Rapid Rewards Plus Credit Card. Best of luck with the companion pass! https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1537058050

Email kap20k4 at hotmail dot com for referrals to both the southwest personal plus card as well as the personal premier card.

If anybody is looking to earn the companion pass, I have the referrals you need. Both the Southwest Plus and Southwest Premier cards with the 50,000 point bonus. Click on the links below for details.

Here is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

and here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

I will get a referral bonus if you apply through my link. Thanks and good luck.

Once you earn the 110,000 points, and the companion pass. Do you have to keep both of your Southwest credit card active? Or can you cancel them? Either one or both of them?

Do you need to have a Southwest credit card to use a companion pass? Do you need to have a Southwest credit card to use your miles?

@jessica- Once you have the points, you could cancel the cards if you wanted. Once the points are in there, you are fine.

I have referrals for both Southwest Personal cards. The Southwest Plus and The Southwest Premier. Both cards have a 50,000 point bonus after meeting the minimum spend. Please e-mail me your first name and e-mail address at bfs711@att.net

I have referrals for both the Southwest Plus and the Southwest Premier card. Both of these come with a 50,000 point sign up bonus after hitting the $2000 minimum spend. This is an easy way to get the Southwest companion pass and after hitting the minimum spend on both cards you will have 104,000 of the 110,000 points needed. The current offer at Southwest is 40,000 points per card. Without the referral you would be missing out on an additional 20,000 points which will make it that much harder to get the companion pass.

Here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

And this is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

Yes I will get a referral bonus if you use my link. If you time it out right and have the points post to your account in January, you can have the companion pass for nearly 2 years. If you like to travel on the cheap, there is no better way to do it.

I have referrals for the Premier card. You will get 50,000 bonus points after spending $2,000 in the first 3 months. My e-mail is chelseafitz03@gmail.com if you would like me to send you the link!

50k link for the premier

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HL&MSC=1536530035 #sponsored

I have 50,000 point referrals for both the Southwest Plus and Southwest Premier cards. Apply for both and you will and you will have at least 104,000 points after meeting the minimum spend. It’s an easy way to get the companion pass.

Here is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

and here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

I will get a referral if you use my referral.

Thanks.

I have referral links for both Southwest Premier and Plus credit cards with 50k bonus below. Thanks in advance for using my referral link

Earn 50,000 bonus points with the Southwest Rapid Rewards® Plus Credit Card. Learn more at.

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1537073853

Earn 50,000 bonus points with the Southwest Rapid Rewards® Premier Credit Card. Learn more at. https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1537400016

I don’t have a business but want to sign up for the card to get the points. How should I fill out the form? I’m sure not everyone who signs up has a business…

Here’s a post that might help you out: How to Get a Business Credit Card

Here are my Links to Southwest Rapid Rewards 50,000 Bonus Applications. Remember if going for the companion pass, to complete your $2000 spending sometime after the end of the year. Thank for using my Links!!

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1536546231

SW Plus 50k – https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHTS&CELL=600V&MSC=1530063807

SW Premier 50k – https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=600G&MSC=1529340613

Best way to get companion pass is to sign up for both these links combined with 1 referral!

Hello,

So I currently have the Premier card with roughly 62k points accrued this year. I was looking to apply for the Plus card in order to get the CP but since the points wouldn’t be earned in the same calendar year is there any way I could still get the CP?

Thanks!

@Phil – Unfortunately, no.

Hi, I’m a business owner and frequent traveler fed up with the new American and switching over to Southwest in 2017. I’ve been looking into this and it appears to be a super offer. I will get both a Premier personal and business card, and would like to get the referral bonus.If you have those, please email me at bbqguy1 at hotmail dot com Thanks!

Southwest Premier and Plus credit card link (each offers 50K bonus points after $2k spend):

Plus

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63GZ&MSC=1527496027

Premier

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63GZ&MSC=1528796328

I also have 7 – 50k bonus SW referral links if anyone needs them. Email me at mimi_n@hotmail.com

This referral is for the SouthwestPlus or Premiere cards only btw

I have 10 referrals available for this awesome Southwest mileage card … Please help me earn points by using my referral codes and earn the max amount of points for yourself!! Email me at atashiawittwer @ yahoo . com I will be alerted immediately and will be able to send you the referral email immediately so you can start earning your points right away.

Currently Chase is only offering 40,000 points for signing up for the southwest card.

Here are links below for the PLUS and PREMIER credit card with a 50,000 bonus points once spending requirements are made.

PLUS

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63GZ&MSC=1512476644

PREMIER

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63GZ&MSC=1512731824

I have a few referrals for both the Southwest PLUS and PREMIER w/ 50,000 Rapid Rewards point. The chase website is only offering 40,000 points. Please email me at phu_anny at hotmail.com for the referral link or you have any questions!

I have referrals for both Southwest Personal cards. The Southwest Plus and The Southwest Premier. Both cards have a 50,000 point bonus after meeting the minimum spend. Click on the links for the details.

Here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

And this is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

With the new year approaching this is the perfect time to apply. After meeting the minimum spend you will have 104,000 of the 110,000 points needed for getting the companion pass. And the best part is the pass is good for the rest of the year you earn it plus all of the following.

If you have any questions you can email me at: (hotdogs are good @ Yahoo. com.) without the spaces and I will get back to you ASAP.

I will get a referral bonus if you use my link.

Thank you

Is it still the case that Chase Reward Points won’t count toward the companion pass?

@Nikki M – As far as I know, yes. Chase points WILL NOT count toward the Companion Pass.

I understand the 110,000 have to be earned within the same calendar year. Heres my question. If I reach my $2000 spending limit for one of the cards on 12/15/16 but they dont apply the 50,000 points until 1/15/17, will those points count for 2016 or 2017? Is it when I spend the money, or when the points are applied to my account?

@Laura Callahan – The points will count when they are applied to your account. So in the above example, they would count towards 2017 because that’s when they went in to your account.

Great article. Been a fan of the website for a while. I just applied for the Southwest Plus personal card through a 50K bonus offer referral link a friend sent me. I got approved!!! Now I’m wondering when I should apply for the Personal Premier card? Right now the bonus on the Premier is only 40K but a friend has a referral link for the 50K bonus offer. Any tips on how long I should wait before applying for the Premier card? Thank you!

@Carlos Delgado – I would wait at least 90 days, as you stand the best chance of getting approved. So MAKE SURE that you don’t get the 50k from the Plus personal card until the beginning of 2017. Then apply for the personal Premier in late Jan/early Feb, get those 50k, and you’ve got the companion pass.

I got both the personal and business premier cards, and plan to get the bonuses in January.

Is there any reason why I couldn’t apply for the Plus card, either the business or personal version, to get an additional 40-50k points which will more than cover the remaining points I need to get the CB? Has anyone ever done this?

@Garrett – 3 different Chase SW cards might be tough. It’s technically feasible, but might be hard to convince them to give you the 3rd one. I’d recommend getting the other 10k another way.

You are right, they didn’t approve me. The reason they gave was “too many requests”.

I ended up getting my wife to apply for a Marriott rewards card with an 80k point bonus. I will transfer the points from her Marriott account to mine, and then to my Southwest account to get the rest of the points needed for the Companion Pass.

I have a few referrals left for the Southwest PLUS and PREMIER credit card w, 50,000 sign on bonus. Please email me at phu_anny at hotmail.com

Currently Chase is only offering 40,000 points for signing up for the southwest card.

Here are links below for the PLUS and PREMIER credit card with a 50,000 bonus points once spending requirements are made.

PLUS

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63GZ&MSC=1512476644

PREMIER

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63GZ&MSC=1512731824

So I’m wondering if our companion pass expires in dec. 31, 2016, if i make the reservation before that date, can we still fly in 2017?

@kels- Unfortunately, no, I don’t think that will work.

Another idea… if you need to buy some points at the end of the year, pre-pay your federal taxes in December (pay1040.com, 1.87% fee). You can get 10000 pts for $187, and the IRS will give you back any overpayment when you file.

@SJC – Hmm…interesting idea!

I have referrals for both the Southwest Plus and the Southwest Premier card. Both of these come with a 50,000 point sign up bonus after hitting the $2000 minimum spend. This is an easy way to get the Southwest companion pass and after hitting the minimum spend on both cards you will have 104,000 of the 110,000 points needed. The current offer at Southwest is 40,000 points per card. Without the referral you would be missing out on an additional 20,000 points which will make it that much harder to get the companion pass.

Here is the link for the Southwest Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827

And this is the link for the Southwest Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153

Yes I will get a referral bonus if you use my link. If you time it out right and have the points post to your account in January, you can have the companion pass for nearly 2 years. If you like to travel on the cheap, there is no better way to do it.

Thanks

I also have referrals for Southwest Premier and Plus cards, each gives 50K Bonus Points after $2k spent in 3 months. All I need is your first name and email address and Chase will send you the offer. buyaola@yahoo.com

Now is the perfect time to try to get the Southwest Companion Pass. If you time it correctly you can have the bonuses post in January and have the pass for nearly 2 years. Right now Chase is only offering 40,000 points but with these referrals you can earn 50,000 per card. After meeting the minimum spend this will have about 104,000 points and will be only 6,000 points shy of hitting the 110,000 needed.

For the Southwest Plus card:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHTS&CELL=63HB&MSC=1526257827 #sponsored

For the Southwest Premier card:

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1526260153 #sponsored

Yes I will get a referral bonus but you will get the companion pass. Win win for both of us. Enjoy :)

Hey Trav, this is a fantastic article.

Hey Jim, great post!

Do you know how quickly you can get the points from the business card once you meet the minimum required spend?

I already have a Premier card and I’m at 80k miles. Would love to earn CP status before these points vanish at the end of the year… If I get the card and spend 2k in November, would it be possible to get the 50k points before the end of the year, or do I need to wait 3 months?

Am I better off just letting those 80k points go and starting fresh next year?

Thanks in advance!

@John – It’s possible, yes. But you do run the risk of just missing it. Usually points post 2-3 weeks after statement closes, although they say it can take up to 6-8 weeks. So you’ll be close. But why not try it? If you do miss it, you’re starting next year with 50k anyway.

What are peoples experiences with changing companions? Can I have a reservation with on person 6 months out and make the change and make a new reservation 1 month out with a different person?

@Greg- According the rules, and what I’ve been told, the person has to be the companion of yours at the time they are flying with you. I don’t, however, know any way they could enforce this. So you probably could book a ticket for someone, change the companion, and still have the first person fly with you even when they aren’t the companion.

Thanks for sharing the information. Gosh, I feel like I’m so late to the game. If only I knew about this a few years ago :( Question though: we are now a family of 4, so traveling costs a bit more than it used to before the arrival of the twins. I just received the reserve. Would you wait until next year to attempt the Southwest awards/companion fare, or do it this year? We’ve been trying to do about 3 trips a year with the twins.

@kristi – I would wait until next year, and I would get it as early as possible next year so you had the Companion Pass for all of 2017 and 2018 (almost 24 whole months)!

And don’t worry about being late to the game – the best time to start is now! And 3 years from now, your friends will say “I wish I had started when Kristi did”.

If you’re short as the year comes to a close, just use your Chase Southwest card to buy gift cards to your frequent stores. Costco (which now accepts VISA), Target, Walmart, Whole Foods, SOUTHWEST, Marriott, etc. etc. Well worth the small interest if you have to pay it in order to get the pass.

Great article even four years later.

I have a referral link for the SOuthwest PLUS & PREMIER 50,000 bonus point. Please email me at phu_anny at hotmail.com. Thank you!

I have referrals for both the Chase Southwest Premier and Plus Visa Credit Card.

Southwest Premier Visa Credit Card- (individual card / non-business)

Bonus: 50,000 rapid rewards points after spending $2000 in 3 months. $99 Annual Fee.

Southwest Plus Visa Credit Card- (individual card / non-business)

Bonus: 50,000 rapid rewards points after spending $2000 in 3 months. $69 Annual Fee.

Email me first name and email address and I will send referral.

Great for earning companion pass!

Offer I believe ends September 30, 2016.

adrpibgal at gmail

Just a quick FYI on the Southwest credit cards for the companion pass, in case this might apply to anyone – Chase (the company that does the Southwest credit cards) has started enforcing a rule for credit card approvals where they won’t approve any new cards from someone who has more than 5 new credit card applications in the last 24 months. So if you’ve been getting some new cards in the past couple of years, beware that this might not work out. Here’s a blog post with some more details: http://thepointsguy.com/2016/07/unfortunate-expansion-chase-524-rule/

Additional FYI – you may get denied even if you are an AUTHORIZED USER on another person’s cards (this happened to my husband). They can count this as another application. However, we called and got this waived for my husband, so if that applies to you then just give them a call and explain what’s up.

I wanted to add a note saying I successfully got both personal cards through Southwest in the past month. After having gotten the first one, I decided there was no reason not to go for the CP (even though I wish I had done it at the beginning of the year, I figure might as well go for it). At first I was declined from the Plus (personal card) but I called the reconsideration line and was super friendly and was accepted! I shifted some credit around but that was no big deal to me, as I am not a big spender. It’s possible, people…just be nice to your Chase customer service reps

I have 50,000 point referrals for both the plus and premier if looking. Email me at mbwhitti at gmail.com

I have a referral link for the SOuthwest PLUS & PREMIER 50,000 bonus point. Please email me at phu_anny at hotmail.com. Thank you!

Do points earned through Chase refer-a-friend links count toward the Companion Pass?

Thanks in advance

If anyone needs a Southwest PLUS or PREMIER card referral, please email me at phu_anny@hotmail.com.

If anyone needs a Southwest PLUS or PREMIER card referral, please email me at phu_anny@hotmail.com.

Or you can also use my referral link below:

SOUTHWEST PLUS 50K REFERRAL

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHTS&CELL=600F&MSC=1523760516

SOUTHWEST PREMIER 50K REFERRAL

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=600F&MSC=1526482181

Do points earned through Chase refer a friend links count toward earning the Companion Pass?

I just earned my CP this month. Do I have to keep 110K points in order for it to carry over to 2017? Also, if I want to have it in 2018, do I have to earn another 110K or will I stay in CP status so long as I have 110K points “banked”?

@Danielle – Congrats! No, you don’t have to keep 110k in for it to carry over. You automatically have it for 2017 once you’ve earned it for 2016.

You will have to earn it again for 2018, though.

I got the personal premier card last October, and the business premier in May of this year not knowing that I needed both cards minimum sons in the same year. So me I need to apply for the plus card.

My first question is, if it’s hard to get 3 cards from SW, what are my chances? I have excellent credit..

And should I apply in October of this year?

Also, I need to clarify. In order to maximize getting Companion pass, do I need to spend the 2k in by the end of 2016? Or do the points have to be in my Acct by by the end of 2016 or Jan 2017 to have the companion pass for almost 2 years? Or what date do I need to make the minimum spend by? Hope this makes sense!

I recently received a SW Premier card. I have earned 59,000 points in 2016. I am trying to earn a companion pass and need to strategize.. If the 50KSW offer holds true, when should I apply for my second card and when should I have the points post? Should I do it ASAP so I have until December 2016 for year one and all of 2017 for year two?

Thanks for the great post! Can you give an idea of how long it takes to get the companion pass after you spend the 2k on the card. We currently have 79,000 miles from air travel and opening the personal card this year- business card arrives tomorrow and we will spend the minimum same day. Hoping for companion pass ASAP- lots of trips this fall! Thank you!

I have a bunch of the southwest plus card referrals. My email is mr.kyle.hill at gmail.com

Do you know of any other airlines where you can earn miles to get a companion pass?

@Alex Velluto- Other airlines have companion passes, but they aren’t any good. They are usually just good for one flight and have a lot of stipulations. The Southwest one is BY FAR the best.

I have 50,000 bonus point referrals for both the Southwest Rapid Rewards Premier and Plus cards and waived annual fee for the first year. I used the 50,000 points to help get my companion pass a few years back and its been amazing for travel to places we normally would not get to visit. Please feel free to email me if you have any questions (kbw3261 at gmail.com)

1. SOUTHWEST RAPID REWARDS PREMIER: https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=601C&MSC=1523538139

Receive an offer for 50,000 bonus points after you spend $2,000 on purchases in the first 3 months from account opening. $99 annual fee applied to your first billing statement.

2. SOUTHWEST RAPID REWARDS PLUS:

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHTS&CELL=601C&MSC=1523665220

Receive an offer for 50,000 bonus points after you spend $2,000 on purchases in the first 3 months from account opening. $69 annual fee applied to your first billing statement.

I have referrals for both the Plus and Premier Southwest Visa. 50,000 points on either card after $2000 spend. Just click on the links below.

Premier:

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=600F&MSC=1526260153

Plus:

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHTS&CELL=600F&MSC=1526257827

Using either of these links will give me 5,000 bonus points and you will be on your way to getting the companion pass. It’s a win win situation for both of us.

enjoy :)

I am my husband’s ‘Companion’ :) My question is this: we don’t necessarily need to go on a round-trip together, right? Example: I plan to fly to see my parents, but husband has work. He will meet me there a few days later and then we will fly back together on Southwest. He should be able to just add me onto the return trip home, right?

@Affifa- Yeah, that will work because you can book each one way ticket separately. So have him book his trip there first, then have him book the way back separately and add you to that.

As of today I have earned 59,000 SW points during 2016. Assuming the 50K offer holds true, you advise me when to apply for the next credit card and when to spend? My points post on the 6th of each month.

Thank you!

Hi Trav, thanks so much for all the great information on this topic. I hadn’t ever heard of doing this until today. I am very interested in getting 2 cards to get the initial 100k in RR points after I spend the $2000 in 3 months on each card.

I found out today on the phone that you get additional RR points for applying over the phone with the Visa department instead of applying online. Not sure how many additional RR points you will get, but a SW CSR advised me of this.

I am curious though, I currently have about 3700 RR points before the credit cards, what is the best/fastest way to earn the additional 6300 RR points if I don’t have any points to transfer from another Chase credit card or hotel points? I would love to utilize this opportunity since it is still fairly early in the year, but don’t want to get 6000 RR points away and not be able to make it by year end.

Thanks for your help in advance!!

One other thing, if I apply for a business card along with the personal, but I don’t have a business can I still apply for the business card? If so, how?

@Rachel – Check out this post for some tips.

@Rachel – You can either spend $6300 to get the points, you could shop through the Southwest shopping portal to get bonus points, or you could transfer hotel points over and they will count as well. Just depends on what is easiest for you.

Hi. I just go approved for the premiere card and I’ve been waiting with bated breath for it to arrive. I thought I was being clever but darn I think I made a calculation error! I was thinking if I hit the 110,000 points by DDecember 31st, I’d get the companion pass in early January thus taking advantage of the 2 year loophole. Upon further investigation it seems I may have outsmarted myself-I.e. if I hit it December 31 does that mean I will only have the co for exactly one year? Do the statement close dates make any difference? Thought I was clearer than I am! Please advise :) Thanks!

@Denise – It depends when your points post. Whenever your points post, that’s when it counts for that year. So if you hit it exactly on December 31st, you’d have it for the rest of that year (basically 1 day) and then the next year. If you hit it on January 1st, you’d have it for that year (365 days) and the next year (another 365 days).

So you want to hit it as close to the beginning of the year as possible. But it’s always really risky to play it too close with those dates. I’d try to get it mid-January so you make sure it doesn’t post in late December and screw you.

When you get to the 110,000 points, are all those points used to “purchase” the companion pass?

Also, do balance transfers count for anything?

@Angela413- Once you hit 110k points, you’ll have the option to pick a companion. That means you have the companion pass. It will show up in your Southwest members account area. So you don’t have to purchase anything. You just get it for hitting 110k points.

Hey Travis! Great article – it finally convinced me to make the leap and go for it, after I’ve kept an eye on the companion pass for a while.

Sadly, I went with the personal card and business card option, and I just got off the phone with the reconsideration line. They declined my application. Oddly, I do have a side business doing marketing and business development consulting (about a year now) in addition to my main gig at an investment firm. I told the woman twice that my estimated revenue was between 7-10k for the year (which is definitely a rough estimate but I’m confident that’s about what I’ll generate). When she later came back she told me they could not extend the card to me because the business was too ‘new’ and they were too blind to if it would do well.

Now, to be totally transparent, I carry about a 40% balance of my total credit line on my personal Chase credit card. She mentioned it, but said it had little to no baring on their decision, and it was mostly because the business is ‘new’ and with revenue of about $7k they could not extend the card to me as it had a minimum limit of $5k.

Lastly, she mentioned that if I started to make more than anticipated, I could re-apply in a month or two and they might reconsider. Is this her way of telling me that my estimate is too low? I have an excellent credit score, and they just approved me for the personal Chase/Southwest card. I’m just curious what I did wrong, as I’d read your tips for calling the business reconsideration line and followed them closely. I don’t want to negatively impact my credit score by having too many inquiries, and I’m not sure how credit requests being denied affect it (if at all), but without the additional business credit card I’ve got absolutely no shot at making it to 110,000 points.

Any recommendations for what to do? I believe the current 50,000 promotion ends the first week of June.

Would love your help!

Thanks, and happy travels.

@Charlotte – yeah, I’d definitely reapply with a higher estimated income amount. Then, you’ll also have more motivation to grow your side business even more! But a higher estimated amount will give you a much better chance of getting the card.

I have referrals for both the Premier and Plus card available! Spend 2,000 in the first 3 months and receive 50,000 points. I was quickly able to get the companion pass by signing up for both of these cards with this bonus. E-mail me at chelseafitz03@gmail.com if you would like a referral and let me know for which card!

Fresh 50K referral codes for BOTH the PREMIER and PLUS cards. Email me for the referral links. bswffmiles@gmail.com

I have referrals for the SW PREMIER CARD for 50,000 bonus points. Please send me your first name and email address to loganmb2@gmail.com . I’d be happy to share tips for getting the extra 6,000 points after both credit card bonuses.

I have 10 e-mail referrals for each of the PLUS and PREMIER cards for 50K points! Email me your first name and e-mail address and I can generate the referral. my e-mail is: alicia4207@gmail.com, and the link will be sent from Southwest/Chase in 3-5 business days!

Currently Chase is only offering the Southwest Premier credit card for 25,000 bonus points.

Here is a referral link for 50,000 when you spend $2,000 within the first three months.

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=600F&MSC=1527567678

I have CODES for the PLUS and PREMIER cards for 50K points! Email me your first name and e-mail address and I can generate the referral. Email is: lindsey_farnish@yahoo.com, and the link will be sent from Southwest in 3 business days!

If anyone is looking for a referral for the Southwest Premier credit card to receive 50,000 bonus points let me know :) fc.frances@gmail.com Happy flying!

Question. If I spend $110,000 a year, every year, on the SWA card, does the companion ticket perk continue each and every year or is there a limitation just for the initial time period (balance of year plus the following year).

@Dave – As of right now, you’ll continue to get it, year after year. No limitation. That can change at any moment, obviously, but right now, you’re good.

I have referrals available for both the premium and plus cards with a 50,000 bonus for each. Email me at devomasch@gmail.com if you want the referrals to help get you the companion pass.

Thanks,

Devin

I have 10 e-mail invites to share with others that would like 50,000 miles on a SW Premier credit card. Once approved, simply spend $2,000 on the card in three months and get 50,000 SW miles.

Send me your first name and e-mail address and I can generate the referral. Currently, the most miles that you can obtain outside of a referral is 25,000. Send e-mail to darrellsgallegos at gmail dot com (darrellsgallegos@gmail.com)

Thank you

This sounds too good to be true. I just applied for a SW card to get 50K points. Could I (after we spend the minimum and get those point) have my wife then sign up for her own SW card, get her 50K points, and then have her transfer her points to me?

@AdamS – No, if she transfer the points to you, it won’t count. The 110k points have to all be earned in the same account, which is why most people get 1 business and 1 personal card. That way, you can tie the same southwest account to both cards and earn 100k quickly.

I have referrals for the Southwest Premier Card with 50000 bonus.

Please use the link below to apply:

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FHV5&CELL=600F&MSC=1507217773

If you are not comfortable using the link please email at tadsml@aol.com and I will have Chase send you a link.

Thank you!

Can you combine the 50k points from Personal and 50k points from business to get 100k points that will count towards the companion pass?

@Mark L – Yep, sure can. Just make sure that you put the same Southwest frequent flyer number in for both when you apply for the cards.

I have 10 e-mail invites to share with others that would like 50,000 miles on a SW Premier credit card. Once approved, simply spend $2,000 on the card in three months and get 50,000 SW miles.

Send me your first name and e-mail address and I can generate the referral. Currently, the most miles that you can obtain outside of a referral is 25,000. Send e-mail to doug56788 at hotmail dot com

Thank you

Please send a referral link. Thank you!

sosillysully@gmail.com

If anyone is looking for a referral for the Southwest Premier credit card to receive 50,000 bonus points e-mail me at chelseafitz03@gmail.com

Referral for the 50,000 Southwest Airlines Rapid Rewards Premier Credit Card

Since I was able to get to the companion pass through a referral, I thought I’d offer the same to anyone who needs a referral for the southwest promotion! Feel free to respond to this comment with your email address and name so I can send you an invite! Thanks :)

Please send the referral link! Thank you so much

I have referrals for SW Premier card with 50,000 bonus at 2,000 spend. If you want one, just send an email to ch31799@gmail.com with “Southwest” in the subject line.

Can I make myself the Companion, thus freeing the middle seat everywhere I fly? I’ve tried to find this answer and can’t. I could call Southwest I suppose.

@Aaron – I really don’t know the answer to this, but I’d love to know. Have you found out?

If anyone needs a referral for the 50,000 point referral for the SOUTHWEST PLUS card, please email me at phu_anny at hotmail.com.

Hi Trav, I always appreciate the info you post. Very helpful. I already have a business card with Southwest with 34K points and I made the mistake of calling regarding the personal card and transferring the points and they said I couldn’t do that. I did get an application from Marriott rewards card to earn $80,000 points. I just don’t understand how to transfer them directly to southwest without going through chase..? Would this work to get my Companion pass?

@Carrie Wolf – Yes, transferring from Marriott to SW will count towards the companion pass. To do this, all you have to do is go to Marriott.com, go in to your account, and then find where it allows you to transfer to a partner. From there, pick Southwest, put in your SW number, and it should work fine.

One word of warning though- 80k Marriott will not equal 80k SW. I’m not sure of the exchange rate at the moment, but last time I checked 70k Marriott got you 25k Southwest. So I would only make the transfer if then you could get the additional SW points some other way and get the CP.

Hi! I have a question. I just booked myself and my daughter for an August flight on a WGA fare. I want to try to earn the companion pass. here are my questions. If I cancel that flight (after earning the CP), I will get Southwest credit for both of us. Can I rebook myself using that credit , and put my daughter on as the companion? (Everyhting says you can book with cash or points, but doesn’t mention using SW credit.) Also, will her credit be available for ME to use, or will they only be available for HER to use in the future.

@Vicki – Interesting questions. I’ve never experienced it before, but here is that I THINK (emphasis on think) will happen:

1) Yes, you could book her as your companion with SW credit.

2) I’m guessing the credit will go to her account and her name.

I’d call and ask though.

I successfully got the 50,000 point bonus from both the Personal Plus and Personal Premiere Cards and now I’m just a few days away from getting my Companion Pass, so be hopeful! I was cautious and waited until January to hit my spending threshold for both cards just to be sure I got the points this year, but I can confirm that the points arrived as soon as the date for that statement month ended.

I do have referrals for the Premiere card 50,000 sign-up if anyone needs one (email @ mattstravelmail@gmail.com).

I’m curious for those that have referrals for the Plus card how you got them? I’ve only got the option for the Premiere card through Chase.

I can’t wait to start using our Pass!

@Matt – Awesome, huge congratulations. The CP is amazing, as you’ll find out! How’d you get referrals for the Premier card?

Also keep in mind that shopping online via Southwest Shopping Rewards at https://rapidrewardsshopping.southwest.com/?chan=c&med=lk&cont=DLP

will also earn you points that count toward your companion pass – and much faster. Many stores have specials for 2x – 10x per dollar. I buy from Home Depot and Nordstrom a lot – both have the option to buy online and pick up in store. And I earned 289,000 points last year for buying what I would normally buy. I always go there first – even when standing in the store – I go online, buy it, and pick up at the counter.

@Kena- Very, very good point. That is a great suggestion. Wow, 289k points – that is a HAUL! And I love the idea of you going online and shopping while in the store – classic!

I’m going to be doing this to get to 110k myself this year since I don’t think I’ll be able to score the SW cards again (since I’ve gotten them before). Thanks!

Question- I just applied and got approved for my personal (filled out apps for both). When I called to get my business one approved/verified they said since I just got approved for personal I would have to wait for 30 days.

So disappointed! Have you heard of this happening? Should I just call back?

@Kate – I would definitely call back. Usually you don’t have to wait 30 days. Call back, and try to get another representative who will get you approved immediately. I always try 3x. If after the third time I don’t get the answer I want, then I give up.

Do the 110K points have to be in the account to receive the CP? Or is it just an accumulation of points? For instance, can we use points while trying to hit 110K points (does Southwest keep track of that)?

@Lindsey- No, the 110k doesn’t have to be in the account at one time. You can use the points while trying to hit it. You just have to earn a total of 110k in one calendar year.

Question. I just opened up the rapid rewards business card and was approved instantly. However, I was denied the personal card. I then had my wife sign up for the personal card and had her card tied to my rapid rewards account. Does it matter that the two cards are in two different names? As long as they are tied to the same rapid rewards account I should receive the points from both cards correct? Im just worried that since its two different individuals I might not get credit for the points. Thanks for the help.

@Austin – Typically, they won’t let someone with a different name tie their card to a different southwest account. I would DEFINITELY call Chase and check to see which account they plan on putting your wife’s points in. Usually, they won’t put it in your account, they will create a different account for her. I’ll cross my fingers that you are able to make it work.

Send me your first name and email address for 50,000 points Premier card referral link

At brian_2447@hotmail.com

Hi Trav,

I was recently approved for both premier and plus personal card, each with the 50,000 point bonus after $2,000 spending. If I purchase Marriott points, will the amount I charge for those points count towards my overall $2,000 spending? Trying to plan this perfectly and get the CP as quickly as possible. Also, how quickly do points post after statement closing? I’ve read different time lengths depending on if you meet the spending limit mid-statement (points post almost immediately after statement closing). Thanks!

@Beth – Yes, buying Marriott points should definitely count towards your minimum spend because it’s a purchase. Points usually post 2-4 weeks after your statement closes, although they say it can be up to 6-8 weeks.

Congrats on getting all that and getting the SW companion pass. It rocks!

Hello!

I’ve been reading up on this SW CP and I’m super interested in it. Both my wife and I are in line for our next card and so I’d love to do this deal. What I can’t find any info on though is this… Can I sign up for a card under my name, get the 50k spending AND my wife sign up under her name separately, get the 50k and both of them apply to the same Rewards account? If so, sounds like a no brainer, but if not i’d be more nervous to have to do both cards under either my name or hers. Does anyone have experience with this?

@Chris – No, you can’t apply them to the same account unfortunately. You’d have to get 2 or your she’d have to get 2. They won’t let you combine points in to the same account if the card is in different names.

I have invites for the 50,000 bonus points for the Chase Southwest PREMIER credit card. Please email me at mari. king. 55@gmail. com (no spaces obviously, trying to avoid spam). Once you email me I’ll send you an invite via email. Now that I’ve sent a few I’ve received feedback that it can take up to 7 days to receive the invite link, so don’t panic if you don’t receive it right away. Don’t forget to check your junk mail!

Hi,

Thanks for your help. have been reading your blog everyday to make my travel plans.. you are amazing. After reading your article about Southwest companion pass – I decided to get 2 southwest credit cards in october 2015 and made purchases exactly as you had suggested. Somehow I messed up with my statement dates (I had called chase to change my statement dates but the change never went through) and all statement POINTS posted on 17th december 2015. That means I was awarded 106009 points on December 2015 and starting January 2016, I have ZERO qualifying points for Companion pass. I wanted to know if you know if theres a any way around this.

I dont want my 106009 points to go anywhere and find someway to earn the companion pass.

@NPBarry- You can TRY to call them and plead your case (call Southwest that is) but my guess is that they won’t budge. Which means that you’ll have to earn 110k SW points this year (2016) in order to get it. That really, really stinks.

Would the hhonors card work for the extra 10K needed?

Earn 40,000 Hilton HHonors™ Bonus Points after making $1,000 in purchases within the first 4 months of account opening*

Read more: http://thepointsguy.com/credit-cards/hotel/#ixzz3wKRz3QcG

@Stasi- I’m not sure if Hilton transfers to SW, and if they do, you have to check the ratio. If it’s 4-1 or better, than yes, that would work.

HEADS UP! I went ahead and went this route – got over 100,000 points with the Hilton Honors Card. only to find that do NOT transfer to SW. The two companies stopped cooperating in 2012. Thought you all should not.

@Debra – Yeah, some of the airline/hotel partnerships shift and change over time, so definitely check before you get points JUST to transfer to Southwest. Thanks for letting us know about Hilton.

Thanks for keeping up on replies to this post! I just spoke with them on the phone and they claimed that applying for two cards would *not* allow me to get 50K points x2 in one account…is this just their standard answer, and it works anyways? I have been trying to find evidence of it working *recently* and I can’t…

@Shauna- As long as you use the same SW Rapid Rewards number when you apply, it will be credited to the same account. I’ve never heard of this not working.

I’m about 8k points short of a companion pass this year. If I buy Marriott points today and transfer them asap, think they’ll post by EOY?

@Andrew- Eeeeek…doubtful. They usually take a little while to post. Can’t hurt, and is probably your best bet, but I wouldn’t count on it. Good luck!

I just recently reached Companion Pass status. I reached A-List a few weeks before that. I can verify that the credit card points do still go toward the CP but NOT A-List. I reached A-List with the number of flights and not points. I have a question. I just booked a my first flight using the CP. I am A-List. Does my companion fly A-List as well? Or will she get a later boarding position? I ask because it is giving me the option to add the Early Bird to her part of the reservation. I hope she gets automatically checked in with me.

@MikeL- I’m not sure if your Companion gets A-list or not. I’m not A-list, so I have no experience with that unfortunately. If you find out, please let us know though. That’d be great to know for future reference.

I emailed Southwest to ask. I was told that even though my companion has to fly the exact same itinerary, her check in is totally separate. So, I am automatically checked in 36 hours ahead of time. She will have to manually check in or buy the Early Bird (24 hour auto check-in). Then, if I want to board with her, I have to go back to her position. Our flight is next Friday. If it ends up any different, I will reply again.

@MikeL- Thanks for letting us know, and if it is different, would be great to hear back!

I really goofed. I’m hoping there is some way to fix it, but I’m doubtful When RR Visa had their 50,000 pt bonus sign up in September, I was able to get both the personal premiere and the regular one. Problem is, while I was charging away on one card, I hit $2000 in NOVEMBER, which means it will appear on my December 2015 RR Statement; thus splitting my $100,000 points – one card will be awarded the bonus $50,000 on the Dec 2015 statment, and the other card will get the bonus on the Jan 2016 RR statement.

I’m sick about it. totally sick. Do I have any recourse?…I doubt it. Should I bother trying to get the additional 10,000 pts in before the end of the year?

Any ideas? I even tried to get the Business RR Visa card just now – called the reconsideration line over the phone, but was turned down flat. The rep said I too recently opened up 2 personal Chase cards. ARRGGGHHHH!

Any advice would be aprreciated.

PS Another question: Since I’d like to try for the CP again in 2 years, should I go and cancel these accounts out, so I will be eligible for 2 new accounts in 24 months?

Thanks!

@Debra- Ugh…yeah, there isn’t much you can do unfortunately. What I would do is this:

Try to get the business version of the card in 2016 sometime. Yes, they denied you this time, but that doesn’t mean you won’t be able to get it later, maybe in March. If that happens, you’ll have 50k that will post in Jan 2016 and you’ll have 50k from the business. That’s your only real option at this point.

I would not cancel those two accounts out. It won’t help. I’d try to get it for 2016 and 2017.

Thanks so much for your input. I’ll try again in March, as you suggested. All the hits on the credit checks don’t help my credit score though. I’ve had excellent credit right along so I don’t want to mess with that either.