Everyone knows that the absolute quickest way to earn tons of frequent flyer miles is to take advantage of credit card sign-up bonuses.

However, most credit cards only allow you to get the sign-up bonus for the credit card one time.

After a while, if you open a few cards, your options will become limited.

The best way to continue to get the best sign-up bonuses?

Open up a business credit card!

However, there are a few differences between opening up a business credit card and a personal card. Here’s everything you need to know about getting a business credit card, from how to qualify to how to apply (even if you don’t have a “business”).

How Almost Anyone Can Get a Business Credit Card (Even Without a “Business”)

Now, before you start to say, “But I don’t own a business,” stop and think for a second.

Is there anything you do to make extra money that isn’t part of your regular salary?

- Do you sell items on eBay?

- Do you do some consulting on the side?

- Babysit or pet-sit for friends?

- Do yard work or snow-plowing?

There are lots of things that people do for extra income that they don’t consider a business but which can be considered one!

Here’s a perfect example:

My mother is a middle school gym teacher. When I first started telling her about the Chase Ink Business Preferred card and all its awesome perks, she was intrigued. However, she told me:

“Travis, I don’t have a business.”

“So you don’t do anything for extra money Mom? You just make your teacher’s salary?”

“Well, I do coach field hockey and lacrosse at the high school and during the summer, I run field hockey camps.”

“Do you make money for that?”

“Yes.”

“Then guess what, you’ve got a business.”

And just like that, my mom, who 2 minutes before claimed she didn’t have a business, was on her way to applying for a business card.

Here are the important things to know:

- You don’t have to be incorporated to be a business.

- You don’t have to have employees to be a business.

- And you don’t have to make a lot of money to be a business.

All you have to do is provide a good or service in an attempt to make a profit.

So start thinking if there is anything you do that could be considered a business. Nothing is too small, and the answer may surprise you!

What If You Really Don’t Have a Business?

This makes things a little more tricky but it doesn’t mean you can’t get a business card.

The definition of a business includes the words “An attempt to make a profit.”

This does not mean that you have to currently be making a profit.

If you rack your brain and can’t think of any way that you currently have a business, you can still qualify for a business card.

Are you planning on starting up a business in the near future?

If so, you may be able to qualify for a business card by applying for a card BEFORE you’ve actually made a profit as a start-up.

The banks will be more hesitant to give cards to start-ups than they will to already established businesses (and remember, when I say “established,” I mean things as simple as my mom’s coaching). But if you go in with a well thought out and convincing plan, you can oftentimes still get approved.

A few things to make sure to mention when going this route are:

- Your existing relationship with the lender. If you already have an established relationship with Chase (or Citi or Amex), make sure to mention this. Tell them that you’ve enjoyed being a customer of theirs for ______ years and that you’d like that relationship to continue.

- Your desire to split your personal expenses from your business expenses. Tell them you want to open up a business card right when you are starting the business because you want to easily track your business expenses and you currently only have personal credit cards.

- Your willingness to move some credit from a personal card to the business card. If they are hesitant to offer you more credit, make sure to mention to them that you’d be willing to take some of the credit from a personal card and put it on the business card. This should help assuage their fears.

Congrats! You’re now ready to apply for a business card. But how exactly do you do that? It’s not difficult, though there are a few additional steps compared to applying for a personal card. Read on to find out the differences.

How to Apply for a Business Credit Card

When applying for a business card, it’s important to understand how to fill out the actual application, as it’ll differ from a personal application.

Most of it will be pretty straightforward, but there are a few parts that might be a touch confusing.

The most important thing is to not make it too complicated. You don’t have to make your business look bigger, better, or more profitable than it is.

Just be honest on the application.

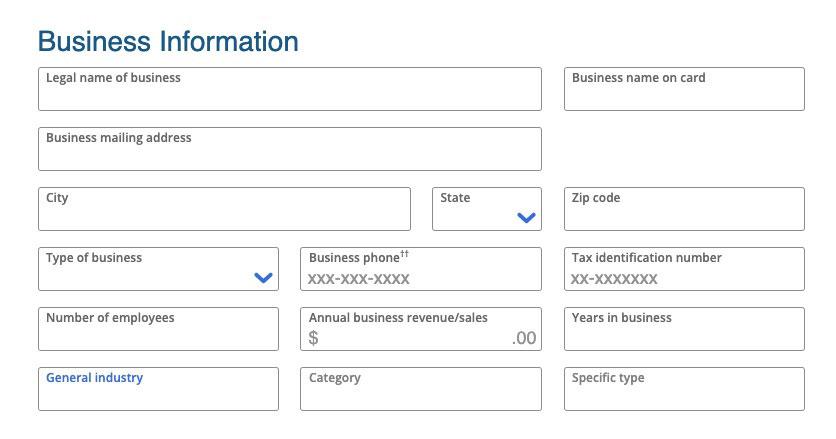

While each bank will have slightly different questions, let’s look at how to fill out a Chase business credit card application. Here’s what to put for each box on the application:

- Legal name of business: Put your own name.

- Business name on card: Again, your name is fine.

- Business mailing address: Use your home address (unless you have a separate business address).

- Type of business: Select Sole Proprietor

- Tax identification number: Use your social security number.

- Number of employees: For most people, this will be 0, unless your business actually has employees. Note that contractors do not count as employees, so don’t count freelancers you hired on sites like Upwork or Fiverr.

- Years in business: List the amount of time you’ve done whatever your business activity is.

- General industry, Category, and Specific type: Select the options that best describe your business. Don’t worry if your business doesn’t fit perfectly in the options the bank gives you.

- Annual revenue: Give your best guess if you’re not exactly sure. If you’re a start-up, you can put 0 in here. You’ll almost assuredly have to explain it later in a phone call, but that’s fine. We’ll explore that in the next section.

The information above is intended for people who, like my mom, don’t have a registered business.

Of course, if you have a registered business (such as an LLC or corporation), you can use that information.

How to Use the Business Card Reconsideration Line to Get Approved Faster

Don’t get frustrated…you’ll have that business card in no time by calling the reconsideration line!

First off, realize that this DOES NOT MEAN YOU ARE DENIED!

Every single person I know, myself included, who has applied as a sole proprietor has gotten this message.

If you want to speed up the process, call up the business reconsideration line.

Waiting for a letter to tell you if you are approved or not can take up to a month, and oftentimes, you’ll be denied because the card issuer couldn’t verify your business.

Instead, take 5 minutes and call the reconsideration line. You can call anytime, even the same day you applied, and will usually get approved immediately.

When you call the reconsideration line, simply tell the customer service rep that you applied for the card and would like to check on your application status.

They will then ask you a few basic questions about your business, such as:

- What is your business? What do you do?

- How long have you been in business?

- How much revenue did you make in the past year? How much of that was profit?

- How much revenue do you plan on making this year? Why do you think you’ll make that amount?

There may be some other, more specific questions about your business, so the best advice I can give you is to take a few minutes and be prepared.

But don’t worry, this isn’t the Spanish Inquisition.

The person on the other end of the line just wants more information about your business.

It’s best to be as honest and personable as possible.

Don’t be nervous; you have an actual business!

I can’t begin to tell you how many people have told me they think they are doing something “wrong.”

I believe it comes from the idea that a “business” has to be a huge entity employing thousands of people.

The sooner you get past that false ideology and realize that a business is ANYTHING (big or small) that someone does to make money, you’ll understand that you have as much right to a business card as Bill Gates or Mark Zuckerberg. (Although you’ll probably be given a much smaller line of credit!)

The Best Business Credit Cards in 2019

There are many good business credit cards out there, and some will be better for your needs than others. However, we want to save you some time. If your goal for getting a business credit card is to earn the maximum number of reward points (as opposed to actual “business” benefits), then there are just two cards we recommend:

Here’s some more information about each:

1. Chase Ink Business Preferred

This is our top pick for a business credit card. If you have the Chase Sapphire Preferred or Reserve, then the benefits of the Chase Ink Business Preferred will be familiar to you.

Key facts:

- Earn 80,000 points after spending $5,000 in the first 3 months.

- Earn 3x points on travel, shipping purchases, internet, cable and phone services, and advertising purchases with social media sites and search engines.

- Earn 1 point per dollar on all other purchases.

- $95 annual fee.

This sign-up bonus is one of the highest we’ve ever seen, making this a great card to apply for while the bonus is this high. The 3x points on travel purchases is also an obvious win for travel hacking.

And remember: this card will earn you Chase Ultimate Rewards points, which are some of the most valuable out there. According to Chase’s calculations, the sign-up bonus is worth $1,000 in travel (what would you do with all that free travel?).

To learn more about the Chase Ink Business Preferred, check out our full review.

2. Southwest Rapid Rewards Performance Business

If you fly Southwest regularly, then the Southwest Rapid Rewards Performance Business card is definitely worth adding to your wallet. The biggest benefit of this card is that its sign-up bonus will count towards earning the Southwest Companion Pass, one of the best travel perks out there.

Key facts:

- Earn 70,000 points after spending $5,000 in the first 3 months.

- Earn 3 points per $1 spent on Southwest® and Rapid Rewards® hotel and car rental partner purchases

- Earn 1 point per $1 spent on all other purchases

- $199 annual fee

The 70,000 points sign-up bonus will be enough for a round-trip flight anywhere in the continental U.S., and it could even be enough for a flight to Hawaii or the Caribbean if you travel during the off-season (late spring and fall, in most cases). And the $199 annual fee is quite reasonable, particularly compared to the high fees for our top personal credit cards.

Business Card Wrap-Up

Business cards can be a GREAT way to earn even more frequent flyer miles quickly and easily, so don’t write them off right away.

Take a few minutes to think about your own business, and what you might do that is considered a business.

Once you’ve found that, don’t let your fear of having to make a phone call scare you. It’s usually painless and takes less than 5 minutes.

If you’re still scared or nervous, take a minute to imagine yourself sitting in an Italian café, while you watch the sunset over the Mediterranean.

Or walking through the vineyards of France, picking grapes off the vine and sitting down to some delicious cheese and red wine.

That’s usually enough to convince people to make that call because the boatload of frequent flyer miles that’ll come your way, as a result, is well worth the small hassle.

And once you do it, you’ll realize just how easy and painless it is. From then, its game on!

What are some of the businesses you have that have gotten approved for a business card? Are there any other questions you have regarding how to get a business card? Let me know in the comments below!

Just applied for a Southwest Business card. I have been doing consulting work for 10 years after retirement. I put on the app sole proprietor and put in my ssn. I was invited to call and could not convince the foreigner who kept putting me on hold why I did not have an tax id number. He would not give me the card. What now?

@skidaddy74012 – Call back. Always, always call back.

Hi Travis!

My husband applied for Chase Ink Preferred using his Name as the business and his SSN as the tax ID. He does side jobs and works as an independent contractor for a friends business. Chase is asking for his proof of Business address. I assume that this is our house. We don’t necessarily have proof of business address since he uses his name and SSN for he business. What proof would work for them? Does he need to register the business before giving them proof?

@Hayli – I would just give them your home address. If he doesn’t have the business registered yet and only uses his SSN, then he doesn’t have an official business address, and so I would just use your home one. As far as proof, I would just call up and explain to them exactly what you just explained to me and that should hopefully do the trick.

Hey Travis, I’d love your advice- I just got rejected for the Chase Business Ink card. The first rejection was for the 5/24 rule but I called and they were counting the cards I’m on as an authorized user so I got them to look past that and reconsider it. I talked to them and provided all the info for my business (provisionsolutions.org) and then just got a letter that I was rejected again for the business being too new with not enough revenue. TI started the business this year as a side hobby and have only had 2 clients but am planning on pursuing it more in 2018, hence why I applied for the card. Anyways- do I try to apply to other company’s business cards like the Citi card? I don’t want to risk another pull on my credit report if I’m going to get rejected again. Is it worth it to call Chase again to ask for another reconsideration, do they do that?

i plan on opening a freight business in a few months and would like to open a business credit card. I dont have be best credit in the world but with my business would i be able to get approved for a business card

@Osazemen- Honestly, it’s probably 50-50. You can certainly try. If you get denied, work on building the credit up and then try again.

do chase ultimate reward points equal Southwest points 1:1?

When applying for a business credit card and you haven’t started your business is there a minimum estimate of annual revenue that is officially needed to get approved? Do you have a recommendation? I was going to list computer repair as my business and i have no idea what my actual revenue would be but i don’t want to get rejected either. I have had a southwest plus card for 10 years and have a fairly high credit limit with no current balance. I was going to open a premier card and a business card. Our credit is excellent. Thanks for any advice.

@Jason – it’s getting tougher and tougher. I don’t know of a hard and fast minimum, but I’d try to make it sound as good as possible.

I have a few questions if anyone has an idea. Is it possible to get one business card as a sole proprietor and another of the same card via my llc (with an application personally guaranteed by me) at the same time? Would a card approved with an llc offer a higher credit limit, assuming all else is equal to the sole proprietorship? Lastly, I do heavy churning with my personal credit–is it likely my application via my llc would be approved where an app for a personal card would be denied due to too many inquiries, i.e. can I successfully guarantee a card if I have too many hard pulls to be able to be approved for another personal card?

Your suggestions for the Southwest Card worked like a charm. I now have both a personal and business card and on my way to the having the free companion fare. I also used your trick to redistribute the credit limits so i could get the United Mileage Plus Explorer card. Worked beautifully.

Hey Trav – quick question. I applied for the SWA personal and business cards, and I did not get approved for the business card because the business I listed was “too new.” While I did call the reconsideration line, the credit analyst said the business’s revenues were just not high enough to justify a $5k credit line.

So what should I do… reapply with a higher estimate of annual revenue, and risk getting denied again? Apply for a second personal card? Wait until the 50k points deal comes up in the fall again? Help! I really, really want the companion pass. But I also don’t want to ruin my good credit.

@Charlotte- Hmmm…that’s tricky. You could reapply in a few months with a higher estimate of your annual revenue. Not sure if you’d get it, but might work. You could also consider going for a 2nd personal card, but that’s usually pretty hard. No real good answer, sorry, but I think maybe the business card again is your best bet.

I tried to fill out the application for southwest business card. In the tax id box, it tells you to fill in the number with out hyphens. However, when you type in the number, it automatically puts in the hyphen, and won’t let you put your tax id number in without it. Because of this, the page won’t let you proceed to the next step. Any thoughts?

@Lori – I would just go and put it in with hyphens then. Try that out, and see if it accepts it.

I called Chase and after a series of questions I was approved for the Ink card. I was originally declined for too many (2) credit inquires in 30 days (I had taken advantage of a credit increase offer on my personal Chase account). I am wondering if Chase would transfer some of my personal credit to my business account just because I would prefer it that way? Is that ok to do and how soon could I call back to request that?

@Steph- Awesome, congrats. Glad you got the Ink!

Yes, you can call and request they transfer some money from one account to another. You could do it right away if you wanted. No worries with timing.

Hey Trav, thanks for the awesome tips on this site. A couple questions.. I appreciate it a ton. My husband applied for the Chase Sapphire Preferred tonight and got instantly approved, and added me as a approved spender. Can I also apply for a separate Chase Sapphire card and get the bonus points even tho I’m going to get one of his cards?

Also, in reference to the business card post- my husband is worried this will make the IRS look at us and get audited or something. Is that a thing? I don’t fee like I have a “real” business, but for fun I paint and sell furniture. Maybe make $200-$300 a month. Will that little revenue pass? I don’t want to get denied and get a ding on my credit. Any other suggestions of cards to apply for?

@Kelsey- Yes, you can get your own Chase Sapphire Preferred as well and you will get the bonus points. Being an “authorized user” on his card will not affect this.

It will be hard to get a business card with only making $200-300 a month. It won’t make the IRS any more likely to audit you, but it will be tough to get approved. Is there anything else you do to make extra income to boost that number? Or do you plan on making more in the future? You could tell them you are scaling up your business.

This morning I applied for the business card online, then called to try to expedite the process. I was declined for “not making enough revenue.” I live near a major college football stadium and rent my yard for parking and tailgating. I only put $4000 for revenue, because I didn’t think it mattered. I actually cleared closer to $5000 this year. They wouldn’t tell me how much is enough revenue. I could rent my whole house for the weekend for about $2000/game or $14,000/year but there’s no way to know if that would be enough. They just told me to grow my business/increase revenue and apply again.

I called back to see if someone could give me a dollar amount for what would be enough revenue. They wouldn’t. However, they did give an additional reason for being declined. They said too many requests for credit. I recently requested and was approved for the Southwest personal premier card which is very similar to the business card. My rationale was to get one for personal use and one for business expenses.

I do wonder if it would have been smarter to go for the business card first since that one seems to have a higher level of scrutiny. Then ask for the personal card after being approved for the business card. In any case, they seem to be cracking down on double dipping points with two cards.

@Phil- They definitely have been cracking down some, for sure. Especially with the business cards. Maybe it would be better to go for the business card first, as I’ve had more problems with business cards than I have with personal cards, that’s for sure.

Maybe try it one more time?

I just wanted to give an update on my delayed success story. I decided to wait a few months and try again for the SW business card. I got the business card earlier this week and already spent the $2000 minimum to get the 50,000 pts. I think my statement will post next week(25 days before 5/7 due date), and I should get the 50,000 pts and companion pass shortly after. I already have 73,000 pts from the SW premier card and other spending.

I’m not exactly sure why I got approved for the business card this time, after being previously rejected. I did increase my revenue to $5000. However, I suspect applying for the personal premier and business card just minutes apart was my biggest mistake. Another potential issue was that I was included on my wife’s Chase Sapphire card which had a $33,000 credit limit. She wasn’t using the card, so she cancelled it. That might have made Chase more willing to approve the business card with a $25,000 credit limit. Regardless, it’s all good now. We’re already talking about how we can take advantage of the companion pass over the next 20 months.

Thanks for all your tips and insights!

@Phil – Awesome, congratulations. The Companion Pass will rock it for you! And yeah, I think it might just be the time between applying. Sometimes, you just have to wait a few months and then you’re all good to go.

I have a ton of Marriott points. Can they be converted to qualifying miles to get the companion pass? Is there a limit to how many points can be converted?

Thanks,

-Greg

@Greg- Yep, they can be converted and they will count towards the CP. I don’t believe there is a limit.

Hi Trav! I’m super new to your website. And I came across this comment. How can I convert that Marriott points towards the companion pass? can they be my husbands Marriott points? Where can I confirm this?

(Sorry for the load of questions. I just want to do this with on mistakes!)

@Annika- Glad you came across my slice of the internet! Yes, you can combine anyone’s Marriott points to your Southwest account. You have to sign in to HIS marriott account and then find the place where you can transfer points.

Once you do that, enter your Southwest account number and make the transfer. Should work smoothly!

Hi Travis,

I’m planning to sign up for the business card. I do not have an EIN but understand I can easily sign up for one. Will I have a better chance of getting approved using a brand new EIN with no history, or simply using my social? Also, will Chase give me points for both the Premier card and business card or will getting one nullify the other?

@Jeff- I’d go with your social. Probably gives you a better chance. I’ve been able to get it using my social pretty easily.

I applied for the business card through a link for 50,00 points and they told me without a tax ID number and a “verifiable” business they cannot approve me for a business card. I actually sell clothes online on the side but I don;t have it registered. Is there any way around this?

@Savannah- Yep, you’ll want to call up the reconsideration line and tell them what you do and explain your business. Here’s a good article on that:

6 Rules to Crush Your Reconsideration Call

I’ve gotten it without a tax id number for my business before and just using my social, so you should be good.

Thanks for enlightning information. I am going to try for Southwest business card. My son-in-law has a real estate rental business with EIN. Can I use his EIN and his business information and apply for a business card in my name. OR I should go ahead and apply with my Soc. number and go into consulting business. Any advice will be appreciated. After this will apply for an individual card to qualify for companian pass.

@Rakesh- I’d personally go with the social security number and consulting. I think you’d be ok using his EIN number, but I’d only do that if you actually did work for his company in some capacity.

Thanks Trav !

Thanks again Trav for your advice. I was able to get both cards, transfer some marriott points. I should have the 110000 qualifying points posted by 1/10/16. My question is how soon can I take advantage of the companion pass after posting points. I intend to fly, with companion, on 1/12/16. I have already booked my flight for that day. Is the pass available as soon the points are posted. Thanks again for all the great information you provide.

I just opened my business a month ago. I have my ein number no bank account can I apply or do I need to have some type of credit first?

@Elvita- You can definitely try to apply. Mention to them it’s a new business, for sure.

I’ve managed a NFP for 18 years, and we have to make a ‘profit’ to stay in biz. Would that suffice for a business card?

@Pablo- Yep, that would count.

So I’ve gathered that it will be best to open a personal and business card after the first of the year to get the most benefit. We are planning on incorporating in January as well. So when registering for the business card with the corporation, are we still allowed to register ourselves as the Rapid Rewards member? Or what are the rules regarding who gets the rewards when a corporation owns the business card?

@Levi- You can simply designate your rapid rewards account to get the points from the business account. That’s no problem at all. You just pick when you apply who gets the points. So when you are applying for the business card, just put in your personal rapid rewards account number. It’ll work fine.

My question in regards to applying for a business card that doesn’t generate a lot of income… How does this affect tax filing? Does it need to be a business you’re generating enough income to need to file it on taxes or have previously claimed on taxes? You used the example of baby sitting or coaching kids on the side so wasn’t sure how that would affect filing your taxes if you’re using this information to obtain a business card. Thanks for any insight!

@Rose- short answer is that it doesn’t affect your taxes at all. Having a business card does not mean you have to file taxes any differently.

I had the same issue “not enough revenue” when applying for the business card. Which negated this whole strategy. Be cautious, they are clearly cracking down on applying for both business and personal cards.

@Kristin- Yes, they definitely are. I’d make sure you had a decent amount of revenue before applying.

What’s up y’all. I need some advice on what to do here. I applied for both the Chase Sapphire Preferred and Chase Ink Plus. The only relationship I have with Chase prior to this application is an Amazon card. The personal card was approved immediately, however the business was pending. I called the reconsideration line today only to find out that my app was denied. I asked why and they said I had to many requests for lines of credit. 2 is too many?? I asked them to reconsider and I told them I wanted to separate business and personal expenses, and that if need be, I’d be willing to move credit limits around. After being on hold for 10-15 minutes, they told me they still could not approve me for a business credit card at this time because my business is “too new”. Any suggestions as to what I should do? Call back? If so, when? And what should I say?

@deez- I’d give it one more call back, can’t hurt. If they don’t approve you this time, I’d try again in 3-4 months. I got denied for a Chase business Ink card before too, and then 4 months later, got approved. Again, can’t hurt to try one more time.

Can renting a room out of your house count as a business?

@Geoff- Of course. I’d tell them that you have rental properties.

Hi Travis,

First of all thanks a lot for App-o-rama. I plan to travel and travel a lot. I signed up for your Udemy course and that was the best thing i did for myself.

I applied for couple of chase cards(personal and business), another barclays frontier card. Frontier card got instant approval. While i had to call for the chase. Got the chase sapphire preferred as soon as i verified myself.

But, My Chase business card application did not go through.

I just wanted to share my experience with the chase business card here and see what i could have done better. The reason for denial was “not making enough revenue”. Now how much is enough revenue ? i mentioned around 2000.

I called in again and spoke to another rep. He said i applied for 2 of the chase cards, and was already approved for one. He asked me why, and i said i wanted to keep my expenses separate for business and personal. Couple more questions just like the previous rep. And then the same reason “Now how much is enough revenue”. I did offer to move some credit to my business account from my personal account but that did not help either. As, the rep said “its the revenue not being enough”.

What could i have done better ? Your thoughts are greatly appreciated.

Thanks.

@Karan- Well, it seems you did every thing right. You gave the exact right answers and said the right thing. Unfortunately, if they say it’s not enough revenue, there isn’t much you can do.

I have no idea what the magic line between “enough” and “not enough” is. Maybe apply in 3-4 months and say a substantial amount more.

I want to thank you so much for the details and encouraging people on doing this!!! I have been wanting to do it for years but a little scared of how the system works and scared I might do something wrong. After reading your newbies section and the business card section I decided I would start… I applied for the southwest business card this morning and was not approved online, so took your advice and gave them a call, rep told me to wail 3 to 5 minutes after just giving my ref # (I was trying to get allt he info in order of my business because I was nervous), rep came back after 2 minutes and he just said “congratulations you have been approved for a line of credit of XXX, do you have any questions?” I made sure to ask about the bonuses points to make sure I will get those, and YES! 60k rr after $3k/3 months. YAY!!! im super excited and will be applying for the personal soon to get the companion pass. Thanks again!!!

@Patty- Woohoo! Congratulations…what an awesome score. 60k is nice, but the companion pass is even nicer. I’m flying tomorrow on it!

Hello excellent website! Does running a blog such as this

take a massive amount work? I have no understanding

of computer programming but I was hoping to start

my own blog soon. Anyways, should you have any suggestions

or techniques for new blog owners please share. I understand

this is off subject nevertheless I simply needed to ask.

Many thanks!

@design blog- Yes, it takes a massive amount of work, but what I’d recommend is this: Start doing it, find your voice, find out how much work it takes, and have fun with it. If you still like doing it after a few months, stick with it. But overall, have fun!

Thanks Travis

Hi Travis, since I’m using my ss# on the business credit application what credit score do I need to have?

Thanks

@Kesha- Typically, you should have 700 or above. That’s the general cut off line.

Hi Travis, I want to keep my personal credit separate from my business. Do you know which cards accept Dun&Brad numbers for business cards?

Thank you for your help and wonderful post.

Rhonda

@Rhonda- I don’t know what Dun&Brad numbers are. If you let me know what those are, I can probably help you out!

Hi Travis,

It’s a 9 digit number given by Dunn & Bradstreet specific to the individual business. I look at it like your business social. It keeps your business completely separate from you. I hope I’m explaining it correctly. Lol

Rhonda

@Rhonda- Is it the same as an EIN number? That’s what I have for my business, and that’s what I use. I believe it’s also 9 digits.

Hi Travis, yes. This is used in place of the EIN, to completely separate the person from their business.

@Rhonda- Hmmm..then I don’t know. I just use the EIN number, that’s all.

So it’s ok to use the card for personal expenses (to meet the spend requirement) even though it’s a business card?

@Britni- Yes, that’s fine.

Trav, how do you suggest you complete the application if you do have a corporation and a tax ID. Should I use that or apply as you suggested?

@Lily- Either one is fine. You CAN still do it as a sole proprietor, but if you have a Tax ID, you can use that too. Whichever you prefer!

thank you for your amazing advice on this blog! my experience: i called for a reconsideration on the southwest business card. partly because i’m trying for a companion pass :) i had already been automatically approved for the southwest personal card and chase sapphire earlier this week (and i’ve had a chase freedom for years). so they were DETERMINED not to give me a business card UNLESS i closed the new chase sapphire. they stated “you’ve been declined for the business card, we’ll mail you reasons why.” but i knew i absolutely wanted the 2 southwest cards + the chase sapphire now. that would give me 140,000 miles for my first week in frequent flyer mile hunting. so i didn’t give up, and called back for other reps. the new reps had notes in my application that i had previously called another rep. they seemed wary so i explained that upon reflection i was calling back with more questions.

finally got connected to a “specialist” who asked me a lot of questions about my business. he kept only offering the business card if i canceled the sapphire because my business was “too new” – it’s less than a year old. but in the end, the specialist offered something the other reps never offered – close my chase freedom card and get the sapphire and 2 southwest. i jumped on it because i can always get the chase freedom again if/when i close the 2 southwest cards. my credit score prob took a bruising this week but hope i made the right call!

@eva_w- Wow, thanks for sharing your experience with us and man, you’re like an old pro! Determination and perseverance certainly paid off. I would recommend at this point laying low from Chase for a while, since you just got 3 cards, but also make sure you do use those cards. If you use them, and they are great cards for everyday spending cards, then you’ll build up a rapport with Chase and they will trust you as a customer.

Congrats on all the cards and miles. And make sure to make the spending at the right time so you can get the Companion Pass when you want it! It’s the best perk out there!

Hey Trav, I just applied for the SPG personal and Business cards got the business approved fast said they were processing the other one, then I checked and found out it was decilined, can you send me the list of reconsideration phone numbers for the different cards especially the American Express

thanks

@Ron- Check out this page for customer service numbers for each card.

woo hoo hoo hoo!!! just applied for and was instantly approved for the american airlines business card.

combined with the visa and amex AA cards i’ve already got, this will bring me up to about 160k miles so far!

THANK YOU TRAV.

@benjamincahn- Nicely done dude, nicely done! Time to gear up for that AA Explorer Award.

Man, I applied for a business platinum and they denied it, but the rep said that I had to wait until I received the letter at home to know the reasons, and then call them back if I wanted to clarify or dispute their decision…but the letter is gonna take 7 to 10 days! And I need to plan my trip to Spain as soon as possible!

@Angel- Yeah, Amex can be some major pains when it comes to reconsideration. Wouldn’t hurt to try to call back again though. If they tell you the same thing, then you just wait the 7-10 days. Frustrating, I know, but….what can you do?

This is a great write-up Trav, which I’ve forwarded along to friends who are reluctant to apply for a business card.

My first business card was the Chase SWA (Companion Pass is the gateway drug), and I was really nervous when I applied for it last year, but it worked out fine. Since then, I’ve also applied for a Cita AA Business card, for which I didn’t even need to call in (it was pending approval after submission, but then automatically approved the next day). I have to confess, I still feel a bit more hesitant to regularly apply for business cards vs personal cards, but I guess that just means I need to apply for more of them so I feel more comfortable about it :)

By the way, once again great pictures! You must have quite a Lego collection in your house!

@Keith C- Glad you forwarded it along. I’ve been giving out advice about business cards so often that I finally decided to put it in a post, and I’m hoping that this helps quell the “fear of the business card” for tons of people. I couldn’t agree with you more that at first I was super nervous to get a business card…but then each time, it gets easier and easier. The doctor says the more business cards, the better for your health!

And if we just remember that a business isn’t just a huge corporation, and that we aren’t doing anything wrong, I think that helps. Then again, I still get small butterflies each time, and I’ve got a real business, so who knows!

As for the legos, unfortunately, they aren’t mine. I spend quite a lot of time searching the internet for the pictures though. Might be easier to just buy the legos myself!

Thanks again for sharing the post, Keith!

Just got the Biz Ink Plus card like 3 weeks ago… back when the promotion required that I had to spend $10k in 3 months. Any idea if my spend requirement is down to $5k as well, or should I give them a call and convince them to give me the better deal?

@Scott- Your minimum spend most likely WOULDN’T have dropped to $5k. However, if you either call them up or send them a secure message from your Chase account you can probably get them to match the offer that is currently available. Chase is usually very good at giving you a better offer if you applied within the last 2 months.

Good luck and let me know how it goes!

Hey Travis,

Was going to email you but i’m not sure and thought others might find this useful. Will I get 5X points on Direct TV even though it’s not technically cable? Thanks!

@Jay- That’s a good question, and one I have absolutely no idea about. On the promotional literature, it specifically says “cable tv” but I’m not sure if they are using that as a general, traditional term or actually meaning only cable tv. I even tried googling it I was so intrigued and couldn’t find the answer. Care to play guinea pig? If you put your Directv bill on the Ink, let us know if you get 5x for it. I’m super curious!

Hi Trav,

In July’12, I was denied Southwest business card due to age of credit history being too small. I got my first credit card 3yrs back and the first chase credit card i got in April’12. Do you suggest I try again now for Chase Ink Plus??

@Yash- There is no way to say with absolute certainty when Chase will consider your credit history long enough. However, I do think that now that it is mid-November, you should have a much better chance than you did in July. Again, this is more of an educated guess than anything, but April to November has now been half a year, so they may consider that long enough, assuming you’ve paid your bills on time for those 6 months.

The only thing I would suggest is that maybe you want to call them and ask before applying. I doubt that they will be able to give you an answer over the phone without applying because the reps you talk to are different than the ones making the decisions for approval or not, but it couldn’t hurt.

If you do decide to apply, good luck, and please let us know how it goes!

Hey Travis,

Guess what… got approved for my first business card :) – chase ink. And that too without needing a call.. Thanks for the advice :). Keep enlightening us :P..

@Yash- Wow, awesome! How the heck did you pull off not needing to make a phone call? Do you have a business with a tax id number? You should be the one enlightening us!

Thanks Travis :). I don’t have a business with Tax ID number. Initially the application status was pending review. And after the holidays(4 days to be precise), I was almost ready to call reconsideration line as I had read everywhere that Business card is never approved without making a call. But I thought of checking the status once again and voila.. I heard I was approved. Looks like a little Thanksgiving gift from Chase :)

@Yash- Wow, that’s incredible. Gotta love those early Christmas gifts…the credit card companies, oh how generous! So did you check the status over the phone?

Yes Travis, checked the status over phone on their AppStatus #.